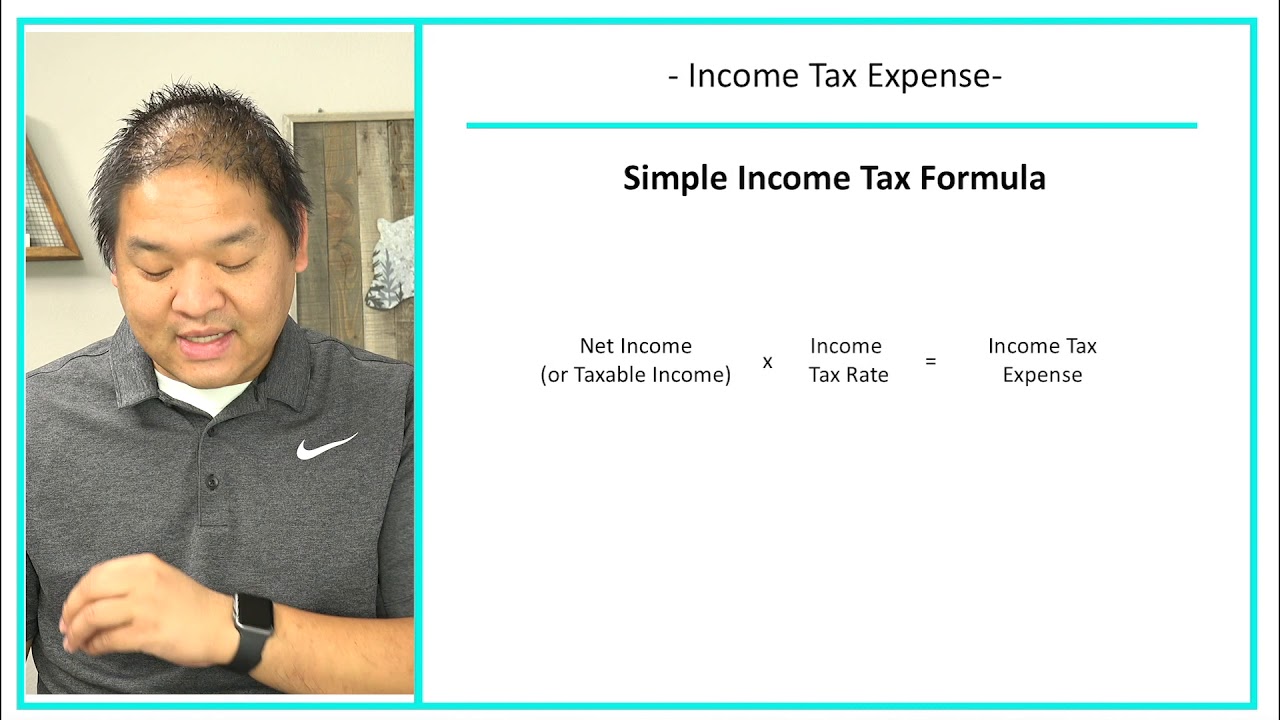

Income tax expense formula

TR means Taxable Rate. 11 An individual may claim a medical expense tax credit for the amount determined by the formula in subsection 11821.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset What It Is And How To Calculate And Use It With Examples

Real Property Other Credits and Deductions.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

. Tax Shield Formula. The effect of a tax shield can be determined using a formula. 2009 Income Tax Withholding Instructions and Tables.

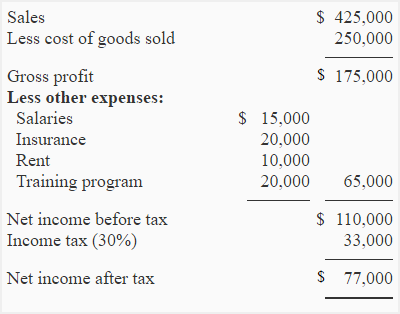

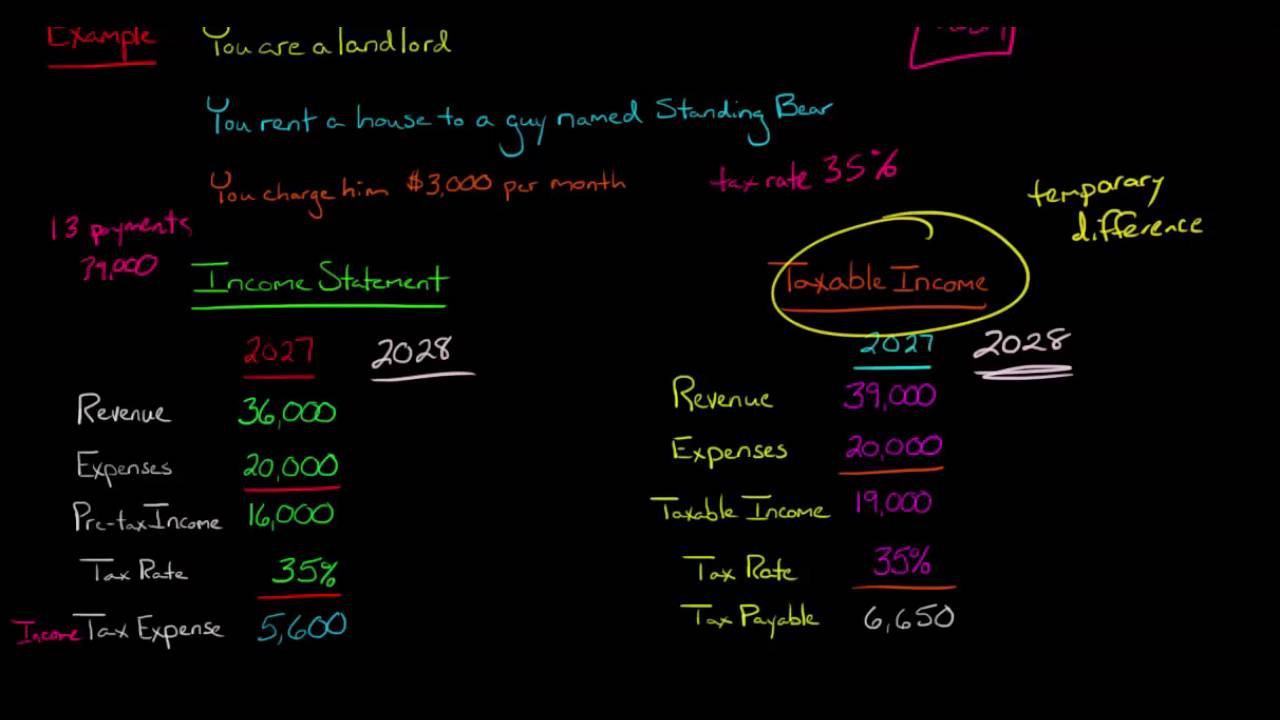

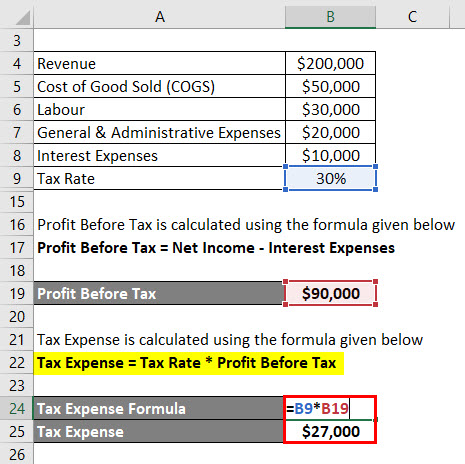

Pretax Income formula Revenues- Expenses excluding Income Taxes Examples of Pretax Income. An investor who invests in tax-free bonds should calculate the pre-tax yield before making the investment decision. To increase cash flows and to further increase the value of a business tax shields are used.

Thus the value added. 2010 Income Tax Withholding Instructions and Tables. The profit before tax value is used to determine how much tax the business has to pay based on its income.

The cost-to-income ratio is one of the efficiency ratios used to gauge an organizations efficiency. A child of the taxpayer or of the taxpayers spouse or common-law partner. Net Income 28800.

Usually the interest on bonds is taxable income. Income. To calculate the income effect of this bonds conversion on diluted EPS we have to add the after-tax interest expense back to net income.

Next determine the net income of the corporation which will also be available as a line item in the income statement. Using taxable investment accounts -- not. Severe Diseases Medical expense is the part exceeding 15000 RMB of the self-paid part of the Social Health Insurance includes diseases not covered in the Medical Insurance Catalogue.

The lower the cost to income ratio the better the companys performance. The formula for the operating expense can be derived by using the following steps. The profit before tax value is calculated based on a formula that takes into account the total revenue operating expenses interest expenses and cost of goods sold.

10000 - 5000 10 - 210 290 RMB in taxes. In this situation sales tax is a liability. It is used to compare the operating expenses of a bank vis-à-vis its income.

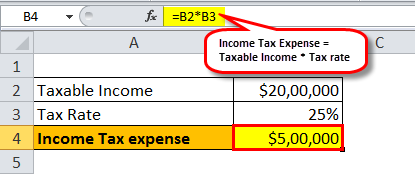

COGS is the aggregate of cost of production that is directly assignable to the production process which primarily includes raw material cost direct labor. Under the formula the lowest tax rate percentage 15 for years after 2006 is multiplied by the total of two calculated amountsThe first calculated amount relates to medical expenses paid in respect of the. To calculate the pre-tax yield use this formula ROI 100-TR 100.

It charges the sales tax to expense in the current period along with the cost of the items purchased. Calculating the medical expense tax credit. Net Income of the company is calculated using below formula-Net Income Total Revenue Total Expense.

In the second most common scenario a company buys any number of items from its suppliers such as office supplies and pays a sales tax on these items. Cost to Income Ratio. EBT formula Operating Income- Interest Expense.

Sackett Laboratories is in the business of. Pretax Income formula Profit After Tax PAT Tax Expenses. A child who is dependent on the taxpayer or on the taxpayers spouse or common-law partner for support.

Taxable income tax rate - quick deduction tax. Sales Taxes for Purchased Supplies. Firstly determine the total expense of the corporation which will be easily available as a line item just above the net income in its income statement.

Buying stocks on margin generates the interest expense most commonly associated with individual investing. Interest expense for personal finance. The net income is a simple formula which measures excess revenue above total expense.

Net Income 50000 15000 5000 1200 Net Income 50000 21200. On an income statement you can view revenues from sales cost of goods sold COGS gross margin operating expenses operating income interest and dividend expenses tax expense and net income. The cost to income ratio is primarily used in determining the profitability of.

Firstly determine the COGS of the subject company during the given period. An eligible child of a taxpayer for a tax year is defined in subsection 633 to mean. 13 As noted in 11 child care expenses must be incurred in respect of an eligible child of the taxpayer.

The formula for a corporation can be derived by using the following steps. Lets understand the concept of Pretax Income with the help of a few examples. However in the case of tax-free bonds the interest income is exempt from tax.

Financial Accounting Lesson 4 10 Income Tax Expense Youtube

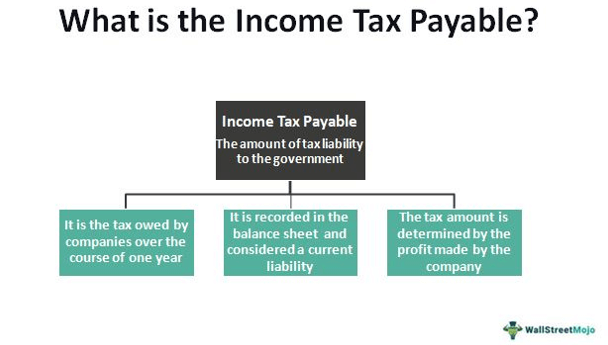

Income Tax Payable Definition Formula Example Calculation

Exercise 19 After Tax Cost Computation Accounting For Management

Calculation Of Chargeable Income Tax Payable Download Table

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Deferred Tax Liabilities Meaning Example How To Calculate

Income Tax Expense Vs Income Tax Payable Youtube

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Nopat Formula How To Calculate Nopat Excel Template

Calculate Tax On Income Clearance 50 Off Www Wtashows Com

What Is The Difference Between Tax Expense And Taxes Payable Accounting Education

Calculating Income Tax Payable Youtube

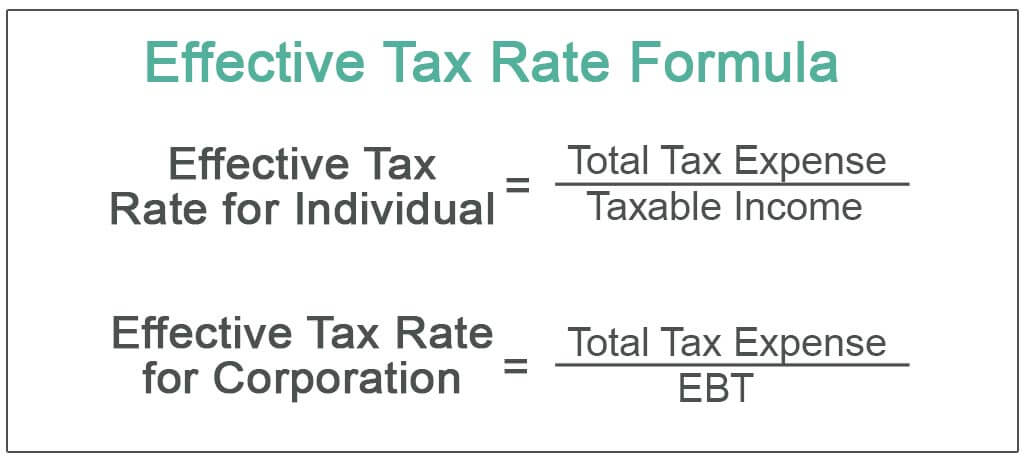

Effective Tax Rate Definition Formula How To Calculate

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset What It Is And How To Calculate And Use It With Examples

Excel Formula Income Tax Bracket Calculation Exceljet

Effective Tax Rate Formula Calculator Excel Template

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics